This is the last part of my strategy series where i will talk about my "Ninja Master Fund". The trading strategy is here. After this I can just concentrate on other things.

Why the fascination with Ninja?

You must be wondering why i named it ninja. That is because of a few reasons:

- Candlesticks is part of my toolkit and that originates from rice traders in Japan (not to mention i love travelling in Japan).

- Ninjas are like assassins. You kill silently and this is how you should behave in the stock market. Ins and Outs with precision and quietly.

- Ninjas are ruthless... in that i mean ruthless in cutting losses when i am wrong.

- Ninjas are flexible... can long and short any positions and play any instruments.

- Ninjas are mysterious... you hide behind a veil. :-P

Anyway, I now managed my own trading account. I used to manage money for other people but i have stopped doing that because i just don't have the time to do it anymore. So instead of looking after other people's money, i decided that 'reporting' to myself is easier and stress free since i hate losing money for friends....

Trading Capital

In trading, you need a decent capital size. Otherwise, it is pretty difficult for proper money management and to take a decent position. Let me use a "story to illustrate" why trading is like a business.

Mr. IPO has finally decided to become an entrepreneur... You must be wondering what business he has gone into and whether he is having mid-life crisis.

What is the business model? Let me give you some clues.

Business model

It is actually quite a simple business. Mr. IPO has decided to be more adventurous and started an "import and export" trading company. Import things which people wants from all around the world (stock exchanges) and then sell them for a profit (trading profits).

Inventory (aka stocks)

In this business, you need to stock up on goods. The inventory to stock up depends on what people wants to buy. On some days, they may want to buy an Apple iPod and on other days, they are interested to buy an OSIM massage chair. You can also use Alibaba to source for the products but you can even use PayPal to pay for your inventory. You use DHL to deliver the goods and the inventory will be kept in a warehouse managed by Global Logistics. Sometimes I may also stock up on brent and in other times, I may hoard gold.

Some inventory can be sold within days (swing trade) and some takes a much longer time to sell (trend trading). Sometimes you can sell the inventory without owning them too! (CFDs and Futures)

Banking facility (aka leverage)

In any business, you will need to have a liquidity facility. When the demand is strong, you may want to import more goods using leverage. You can also pay them in SGD or USD depending on how you foresee the forex movements. Euros is currently a dirty word. (I haven't trade in forex yet...but the leverage is very attractive... but imagine you short CHF and go bust....over leverage can kill you too...)

Minimizing the cost of doing business

If you intend to trade for a living, you must find the cheapest cost of doing business. I think i have one of the lowest costs around. I used to aspire to be a broker/dealer one day but i think the margins are just too low, so i have since given up that "aspiration."

Below are some of the rates which i get....

Solid Platform

I need a solid platform that can place in complicated orders like OCO, Buy Stop, etc... so if you are contemplating full time trading, you will need a good trading system as well but if you are an investor... then this is not as critical.

Ninja Master Fund

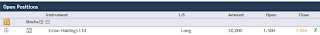

Ninja Master Fund has a capital of $250,000....but because i have no time to trade and monitor the market, I actually set a very low return target of around 10% to 25% for the entire year. Let's see if i can achieve it by end of this year.... so far it's off to a slow start... trading in Apple, Simsci and CWT...

Happy trading :)